KiwiSaver Basics

Still getting your head around what KiwiSaver is and how it works? We got you. Get across KiwiSaver with our easy as 101 guide to the basics.

Why should I join KiwiSaver?

In 2007, the New Zealand government set up KiwiSaver to make it easy and accessible for all Kiwis to get saving. KiwiSaver is a long-term investment savings scheme, open to all New Zealand citizens and permanent residents.

Once you opt into KiwiSaver, you make regular contributions, which are deducted out of your income. That money is then invested for you by your KiwiSaver provider (like us!) into investment funds with the aim of growing your money over the years.

made from your invested money, you’ll start to notice that you have a pretty sweet nest egg put aside for your future.

contributing to your KiwiSaver account, the quicker you’ll build up some serious savings. And you’ll be pleasantly surprised how quickly this can happen!

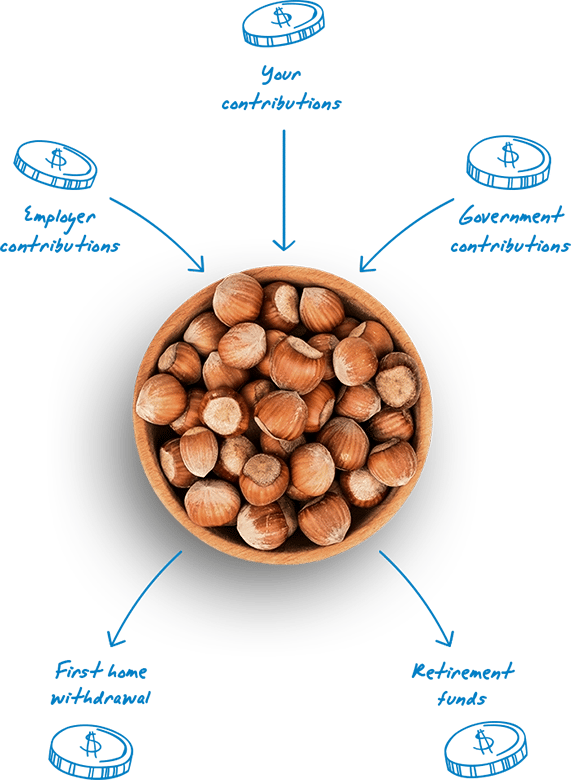

every time you make regular contributions, your employer does too. And once a year, the government will even pitch in as well – up to $260!

Ways we contribute to the NZ economy

from Jan 2009 to 12th Dec 2024

from Jan 2007 to Dec 2024

How it all works (it's pretty easy!)

The basics

Your KiwiSaver account is an investment account. This account is there to grow your savings through regular contributions, and by investing these contributions. You can choose the type of investment fund that your money is invested in, such as a Conservative, Balanced or Growth fund (more on this later!).

Your KiwiSaver account and investments are overseen by a KiwiSaver provider that you can choose. If you don’t choose your own provider, your account will be allocated to one of the six government-appointed default providers. (And, yup, Booster is one of them!)

Your provider works with you to support you in your savings goals. They provide and manage the investment funds that your KiwiSaver savings are invested in. They will also do things like keep you updated on how your account is performing, offer advice if you need it and keep you informed throughout your savings journey.

So, who else – other than you – contributes to your KiwiSaver scheme?

Well, the good news is, you’ll have some help in the form of your employer and the government. And there are other things you can do that should see your balance steadily grow over time. Before you know it – you have your very own nest egg! How easy is that?

If you’re in paid employment, your contributions are made automatically from your wages every pay cycle, so you won’t even have to think about it.

You can choose to contribute 3%, 4%, 6%, 8% or 10% of your pay (before tax). And if you wish to change your employee contribution rate at any time, you can.

Note, from 1 April 2026, the minimum contribution rate will increase from 3% to 3.5%, and then to 4% from 1 April 2028. However, you will be able to apply to Inland Revenue to keep your contributions at 3%. If you choose to do this, your employer can elect to match that rate and only pay 3%.

When do my contributions appear in my KiwiSaver account?

Although your contributions are deducted in line with your pay cycle, they don't appear in your KiwiSaver account straight away. There can be a small delay of around 4-6 weeks from when your contributions are deducted to when they show up in your KiwiSaver account. This is because your employer forwards your contributions to IRD first.

Once IRD have processed the contributions, they are sent to us to put into your account.

Currently, if you’re employed and between the ages of 18 and 65, your employer also contributes 3% of your salary in regular employee contributions towards your KiwiSaver scheme.

From 1 April 2026, the minimum employer contribution rate increases to 3.5%. However, if you apply to Inland Revenue to keep your contribution rate at 3%, your employer can choose to match that rate.

From 1 April 2026, employers of KiwiSaver members aged 16 and 17 are also required to pay employer contributions.

If you are on a savings suspension or your employer is paying into a super scheme for you, your employer does not have to contribute to your KiwiSaver account.

If you’re self-employed or unemployed, you can still contribute to your KiwiSaver scheme, choose how much you want to contribute, and be eligible to receive up to $260.72 of the annual Government Contribution.

As long as you regularly contribute to your KiwiSaver account, and are not earning an income over $180,000 per year, the government will also chip in every year until you are eligible to take your money out as a retirement benefit at the age of 65. These are called Government Contributions (GC).

For every $1 you contribute the government will put in 25c – up to $260.72 each year. From 1 July 2025, government contributions apply to all KiwiSaver members aged 16 years+.

To receive the full $260.72, the minimum annual contribution you need to make is $1042.86.

Have a little extra money in your piggy bank? You can make extra payments outside of your regular KiwiSaver contributions into your KiwiSaver account at any time. These are called voluntary contributions.

You can do this by setting up regular direct debit payments or making one-off payments.

You can do this either online or in your mybooster account.

Investment funds and how they grow your savings

Thanks to all those regular contributions, the money in your KiwiSaver account is building up. And it grows even more when it’s invested. The fund you choose can make a big difference to your KiwiSaver balance in the future.

As the money in your KiwiSaver account starts to grow from those investments, your returns are invested again… and over and over again! Until you have a decent sized nest egg that will support you in your retirement.

This investment growth is a beautiful financial life cycle known as “compounding returns”. And you don't have to do anything except keep on contributing!

Depending on your savings goals and stage in life, certain funds may be better suited to you than others. And this may change over time as your financial needs and goals inevitably change throughout life.

To cater for these different situations, there are three main types of KiwiSaver investment funds – Conservative, Balanced or Growth funds.

A good starting point is to ask yourself what your savings goals are. Are you using your fund to save for your first home or retirement? What is your investment timeframe - are you looking at using your savings in the next five years or in the next 30 years? What level of risk are you comfortable with?

The answers will help you select a fund – such as Conservative, Balanced or Growth – that your KiwiSaver savings will be invested into.

The word ‘risk’ sounds scary when you’re thinking about investments, but it isn’t!

In the world of investing, the term ‘risk’ is often associated with the expected return on your investment.

A fund with more risk generally means bigger returns over the long term, with some ups and downs along the way (a.k.a. market fluctuations or volatility). A fund with lower risk usually means lower returns, but with less market fluctuations or volatility.

Even if you think you might not be comfortable with risk, consider your investment time frame when choosing an investment fund. Generally, if you have a longer investment time frame, you’ll most likely benefit from being in a Balanced or Growth fund. And if you’re planning on accessing your KiwiSaver savings in the next 2-5 years, you might be better suited to a Conservative fund.

And don’t worry – we’re always here to walk you through this part of the process and offer advice, based on your preferences and goals.

Now you have some savings, you may want to access your KiwiSaver savings for one of those big life events.

You can choose to use some of your savings as a deposit for your first home.

Or when you reach the New Zealand retirement age of 65, you are eligible to access your savings to support yourself as you finally take your well-earned break.

And sometimes life throws you curve balls. You may find you’re facing significant financial hardship or a serious illness.

Should any of those things happen, you can apply to access your KiwiSaver savings to support you through these times.

Choosing a fund

You can also choose the type of investment fund that your money gets invested in, such as a conservative, balanced or growth fund. The fund you choose can make a big difference to your KiwiSaver balance at retirement. (Don’t worry - we can help you select an investment fund that best suits your needs.)

Sounds great! So, when should I start saving?

The sooner you start contributing to your KiwiSaver scheme, the quicker you'll build up some serious savings. If you contribute regular amounts for longer – even if it's just a small deposit each time – you’ll be in a much stronger financial position down the line.

The longer your money stays invested, the harder your money works for you (compounding returns, remember?). Imagine what you could save if you participated in the KiwiSaver Scheme for 20 years as opposed to 10 years?

Every little bit makes a difference! Don’t believe us? Have a go on our KiwiSaver calculator. It will give you an estimate of what your savings will be by the time you retire, based on your current age, income and contributions.

We're here to help

Taking the first steps towards your financial future can be overwhelming. But it doesn’t have to be with us.