Calculate your KiwiSaver

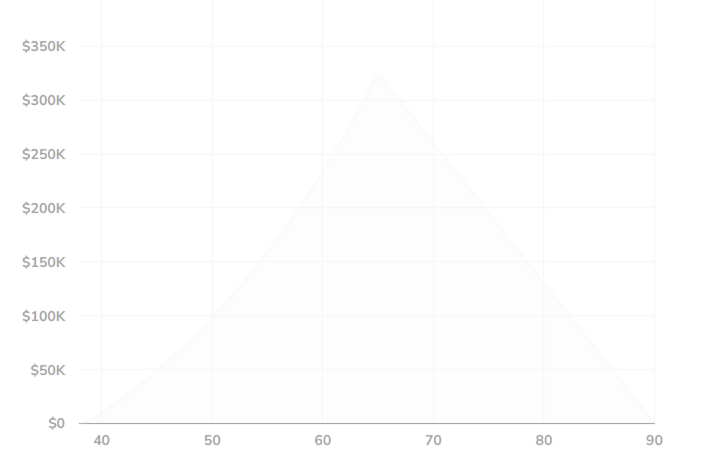

What could your retirement look like?

Choosing the right fund, and how much you put into your KiwiSaver account, can make a big difference to how much you end up with at retirement.

*Industry-standard forecast rates of return (after fees and tax at 28%) as set by the FMA, across four main fund types.

See the Booster's rates in our funds.

We’ve calculated your results based on the information you entered, and some industry-standard investment return, inflation and salary increase assumptions as set by the Financial Markets Authority (FMA). Our calculator is intended as a guide only and only relates to your KiwiSaver account.

- Industry-standard forecast rates of return (after fees and tax at 28%) as set by the FMA, across four main fund types:

| Fund type | Annual return |

| Conservative | 2.5% |

| Balanced | 3.5% |

| Growth | 4.5% |

| High Growth | 5.5% |

- No savings suspension or withdrawals take place.

- If you’re employed, we’ve assumed an annual salary increase of 3.5% and a 3% employer contribution. The calculator accounts for this salary growth and excludes the Government contribution in any year where the projected income is over $180,000.

- If you're self-employed (or not working), we've assumed your regular annual voluntary contribution increases by inflation (2%) each year.

- Your annual government contribution entitlement amount is received each year, up to a maximum of $260.72. This figure is not adjusted for inflation.

- Fees, tax rates and government contributions are assumed to continue unchanged until you reach age 65.

- All projected balances are in today’s dollar terms (by adjusting for the impact of inflation at 2% per annum).

- After age 65, the graph shows the projected weekly retirement income your lump sum would give you over a 25-year period, assuming a 2.5% annual return (after tax and fees) and a 2% annual inflation adjustment.

- The default contribution rate will increase to 3.5% from 1 April 2026 and 4% from 1 April 2028. You may apply to Inland Revenue to maintain a 3% rate, and your employer may match this. These changes are not included in the estimated lump sum savings total.

- Calculator does not allow the user to adjust the employee contribution amount.

Remember, this result is a guide only and several factors affect the size of your retirement savings and how long this might last in retirement. These include:

- Your choice of fund

- Your contribution rate

- How long you contribute for

- If you are using KiwiSaver to save for a first home

- Other retirement savings and income you may have

- Your expected retirement income levels

- The actual performance of investment markets

If you want a more personalised plan for your KiwiSaver, give us a call on 0800 336 338. We’ll get your KiwiSaver money working harder for you.

Not sure which fund is right for you?

Here’s a few steps you can take to help you work out what approach is best for your financial future.